Mohnish Pabraiのカッコよさ

Mohnish Pabraiについては、当ブログでも何度か取り上げています。エンジニア出身で、1994年にバフェットの伝記を読んだことで投資家としてのキャリアをスタート。1999年からPabrai Investment Fundsを運用しています。私が彼を尊敬するところとは、師匠の教えに忠実であるということです。彼は機関投資家での勤務経験がないため業界の常識に染まっていないという見方もできますが、バフェットの初期パートナーシップと同じく、毎年の運用成績が6%を超えた部分の25%という成功報酬のみを受け取っています。仮に運用成績が10%であれば、(10%-6%)x 25% = 1%の成功報酬を得ることになります。

リーマンショックでは、ファンドの運用成績が前年比-70%まで悪化したそうです。年初に100あった運用資産が30にまで目減りしたわけで、成功報酬モデルにとっては悲惨な状況です。しかも、成功報酬をもらうためのハードルは年間6%づつ高くなっていくのです。100>106>112、、、という具合です。結局、Pabrai氏は2017年まで10年間、無報酬でファンドを運用していたそうです。Warren Bufefttの相棒Charlie Mungerは、取締役を務めるDaily Journalの2018年次総会で、Pabrai氏の行動について賛辞を送っています(書き起こし全編はこちら)。以下に抜粋します。

—————————————————–

Question 9: This question is for Mr. Kauffman. You mentioned about the “five aces” and aligning the interests with investors with the right fee structure to benefit both. What have you seen as a good fee structure, both from a start-up fund with say $50 million in assets, and then the larger funds with assets over billion?

Peter Kaufman: I’ll let Charlie answer that because he can describe to you what he thinks is the most fair fee formula that ever existed and that’s the formula in Warren Buffett’s original partnership.

Charlie: Yeah, Buffett copied that from Graham. And Mohnish Pabrai is probably here…is Mohnish here? Stand up and wave to them Mohnish. This man uses the Buffett formula, and always has, he just copied it. And Mohnish has just completed 10 years…where he was making up for a high water-mark. So he took nothing off the top at all for 10 years, he sucked his living out of his own capital for ten long years, because that’s what a good money manager should be cheerfully willing to do. But there aren’t many Mohnish’s. Everybody else wants to scrape it off the top in gobs. And it’s a wrong system. Why shouldn’t a man who has to manage your money whose 40 years of age be already rich? Why would you want to give your money to somebody who hasn’t accumulated anything by the time he was 40. If he has some money, why should he on the downside suffer right along with you the investor? I’m not talking about the employees under the top manager. But I like the Buffett formula. Here he is, he’s had these huge successes. Huge in Buffett’s career. But who is copying the Buffett formula? Well we got Mohnish and maybe there are a few others, probably in the room. But everybody wants to scrape it off the top, because that’s what everybody really needs, is a check every month. That’s what is comforting to human nature. And of course half the population, that’s all they have, they’re living pay check to pay check. The Buffett formula was that he took 25% of the profits over 6% per annum with a high water mark. So if the investor didn’t get 6%, Buffett would get nothing. And that’s Mohnish’s system. And I like that system, but it’s like many things that I like and I think should spread, we get like almost no successes spreading that system. It’s too hard. The people who are capable of attracting money on more lenient terms, it just seems too hard. If it were easier, I think there would be more copying of the Buffett system. But we still got Mohnish. (laughter)

—————————————————–

そんなMohnish PabraiのYouTube動画は、全てお薦めです(動画リンク)。

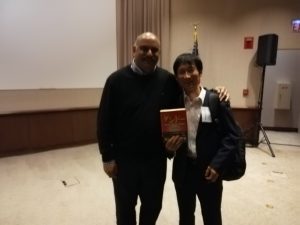

(Pabrai Investment Fund 年次総会にて@シカゴ)

Pabraiさん、本当にありがとうございます。

Happy Investing!!